Gen AI and Financials Pt 2

- AI Guy

- Jul 6, 2024

- 2 min read

As already demonstrated in Pt 1, Gen AI has many uses in the analysis of financial statements, from extracting data to the execution of the analysis itself. This is using the same methodology as mentioned in Pt 1, with the following additional findings:

Comparing Microsoft's CoPilot to Google's Gemini Flash 1.5 (not even Pro 1.5, their flagship model), I again found Gemini to be more accurate on data extraction.

Prompt engineering can increase the accuracy of data extraction even further.

Repeating the process in Pt 1, including all the write ups below, only took 1.5 hours this time, allowing the analysis to be executed and distributed the morning after financials were published, demonstrating the scaling returns of automation and smart use of AI throughout a traditionally manual process.

I've skipped the piece on asking Gen AI to look at this for now, Gen AI analytical capabilities will be explored in more depth in a future blog.

The rest of the article follows the analysis of results published in Jun 2024 of a specific property, relevant to certain readers, but if you're here for Gen AI only and have already read Part 1, you can skip the rest of this blog.

Analysis Results - Human

In summary, 2023 actuals generated a surplus of ~£500k (vs deficit of ~900k in 2022), so a YoY move of ~£1.4m due to the following:

a. Income increased by ~£1.1m YoY largely resulting from service charge increases.

b. Expenses decreased by ~£300k YoY, and £400k below budget.

It should be noted that the biggest contributor to the "surplus" is that 0 contributions were made to the reserve in 2023, compared to £500k in 2022 - this is the main reason why expenses decreased £300k YoY.

These net movements are explored in detail below:

On income, service charges increased 32% year on year, which brings revenue in line with expenditure. Note also reduction in pocket park contribution.

Overall, expenses drifted down 5% which is good, given inflation in 2023 was extraordinarily high, coming in at 7.3% annually, creating a "net benefit" of ~12% in 2023.

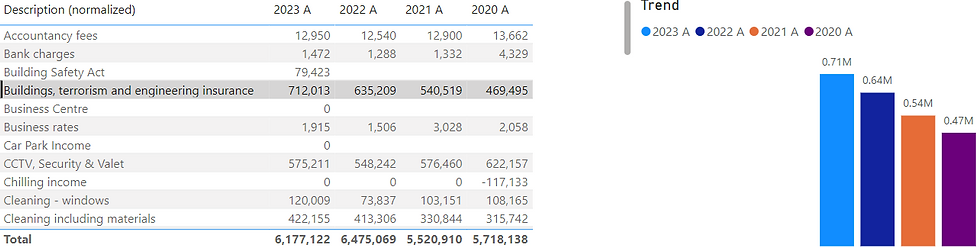

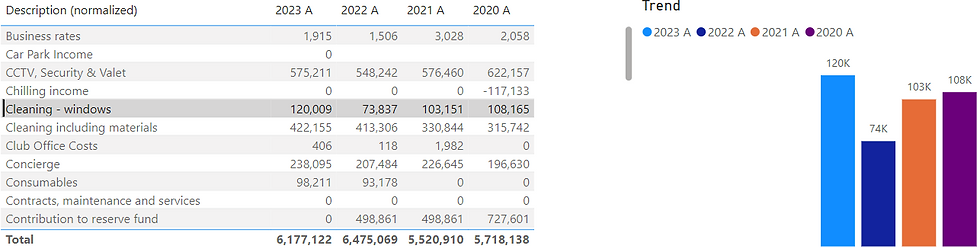

However, peel back the layers and there are some unusually high increases in expenses: 1) These are the largest increases, note they are both above 2022 actuals and the 2023 budget. Window cleaning and water also seem unusually high.

2) New expense items are worth checking, BSA already mentioned in cover letter, refuse collection is probably the cost in creating the new collection room, but heat consumption costs seem unusual.

3) These are the ones significantly above annual inflation of 7.3%, worth understanding why uniforms cost so much now. If we have headcount numbers we can see average cost per person too. Note Sky Lounge tracks inflation but is significantly above budget.

Balance sheet analysis skipped as it talks about debts and accruals, will be explored in depth with freeholder instead.

Expense trends - expand to see details

To highlight how much some of these expenses have gone up over the years, see below, cleaning, repairs, landscaping, recruitment, sky lounge/cinema, telephone, uniforms, water all jump out. In particular, telephone and water increases look suspect as demand in terms of users could not have increased by the proportions shown below.

Comments